Pin on Saving Money Tips

In Baby Steps Millionaires, you will: Take a deeper look at Baby Step 4 to learn how Dave invests and builds wealth. Learn how to bust through the barriers preventing you from becoming a millionaire. Hear true stories from ordinary people who dug themselves out of debt and built wealth. Discover how anyone can become a millionaire, especially you.

This Dave Ramsey Baby Steps PDF printable is a fun and simple way to

Baby Step 1: Save $1,000 for Your Starter Emergency Fund Only 32% of Americans say they can pay cash for a $400 emergency. 1 That means 68% of them are borrowing, selling or going into debt when life happens. And it does. Your car's catalytic converter gives out. Your kid busts his chin and needs stiches from the ER.

Basic Overview of Dave Ramsey’s 7 Baby Steps HassleFree Savings

The 7 Baby Steps Explained - Dave RamseyNix the guesswork and scrolling. We'll connect you with investment pros we trust: https://bit.ly/3hc6PgtVisit the Dav.

Are you looking for a free debt snowball worksheet to follow Dave

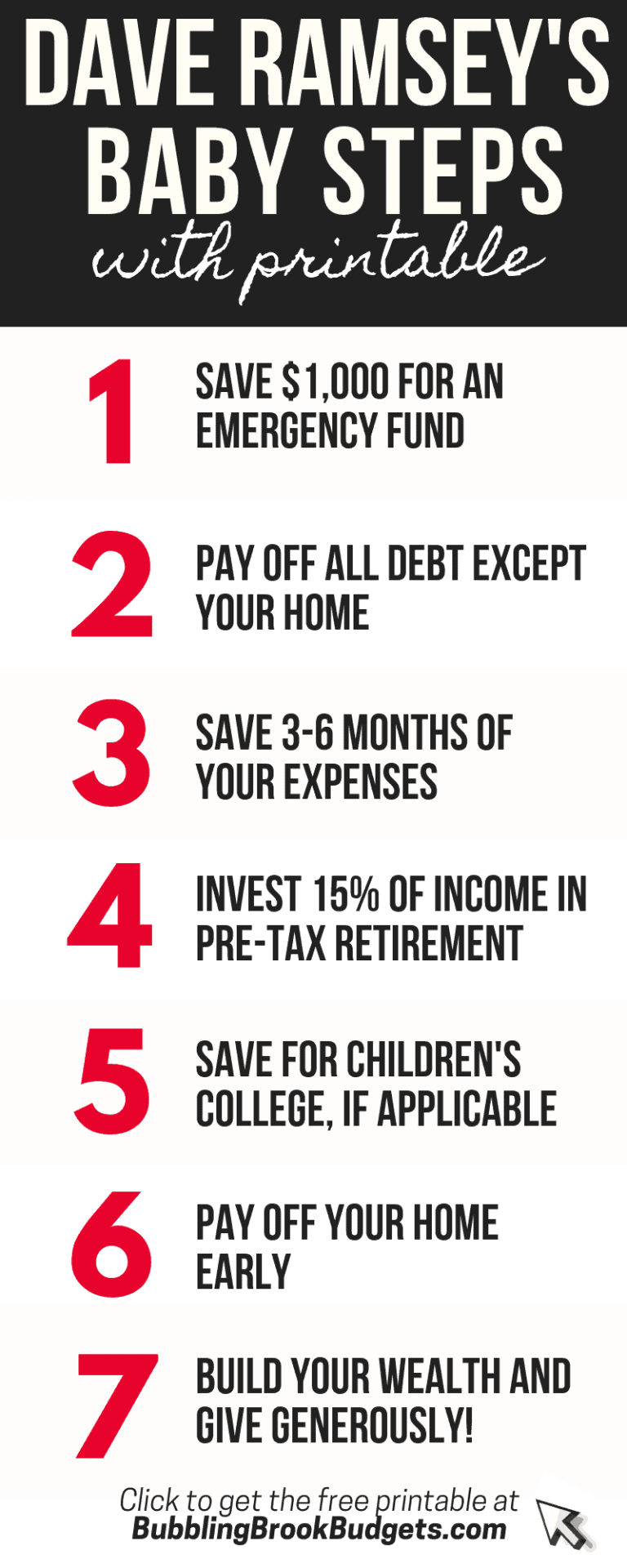

Baby Step 1 - Save $1,000 for your starter emergency fund. Baby Step 2 - Pay off all debt (except the house) using the debt snowball. Baby Step 3 - Save 3-6 months of expenses in a fully funded emergency fund. Baby Step 4 - Invest 15% of your household income in retirement. Baby Step 5 - Save for your children's college fund.

Dave Ramsey Baby Steps Pdf Download

Free Dave Ramsey Baby Steps Printable PDF to print out and keep in your budget binder as you check off the steps. Stay motivated with this cute printable!

The Dave Ramsey Baby Steps UK Version Wanna Be Debt Free

If you're following Dave Ramsey's 7 Baby Steps, you know that Baby Step 2 is to pay off all debt (except your house) using the debt snowball. So, once you're current on all your bills and have $1,000 saved for your starter emergency fund, it's time to get that snowball rolling! How Does the Debt Snowball Method Work?

Dave Ramsey's 7 Baby Steps

Pay off your mortgage. Build wealth and give money to charity. If you're looking for a way to track your progress throughout each baby step: Here's a Dave Ramsey Baby Steps Tracker. It's a printable PDF. There are color and black & white options. If you're interested in purchasing this printable, you can click here to get a 15% off coupon.

dave ramsey baby steps Financial peace, Dave ramsey financial peace

Built with ConvertKit Are Dave Ramsey's Baby Steps the Right Financial Plan for Large Debt? The Dave Ramsey plan is not for me. I make a large income. I can afford a car payment, a nice house, and I totally deserve those cute shoes I saw yesterday. These are a few things I used to tell myself. I now realize they were keeping our family crazy broke.

The Dave Ramsey Baby Steps UK Version Wanna Be Debt Free

What are the 7 Baby Steps? 3 months ago Updated You win with money the same way you learn to walk one step at a time. That's where the 7 Baby Steps come in. Here's the process: Baby Step 1: Save $1,000 for Your Starter Emergency Fund In this first step, your goal is to save $1,000 as fast as you can.

Quick Start Guide to the Dave Ramsey Baby Steps (w/ Printable PDF

The Seven Baby Steps - Begin your journey to financial peace Baby Step 1 - $1,000 to start an Emergency Fund An emergency fund is for those unexpected events in life that you can't plan for: the loss of a job, an unexpected pregnancy, a faulty car transmission, and the list goes on and on.

Dave Ramsey’s Baby Steps How Do It Info

Dave Ramsey's 7 Baby Steps - Ramsey Find Out Which Step You're On Step 1: Save $1,000 for your starter emergency fund. Step 2: Pay off all debt (except the house) using the debt snowball. Learn More Step 3: Save 3-6 months of expenses in a fully funded emergency fund. Learn More Step 4: Invest 15% of your household income in retirement. Learn More

Dave Ramsey's Baby Steps and Why They Work [2020 Update]

7 Baby Steps 7BABY STEPS TO FINANCIAL FREEDOM Baby Step #1: Save $1,000 to Start an Emergency Fund In this rst step, the goal is to save $1,000 as fast as you can. An emergency fund is for those unexpected events in life you can't plan for.

dave ramsey seven baby steps pdf Lorna Mcbee

Baby Step 1: Ramsey's first step is to save $1,000 for your starter emergency fund. Baby Step 2: Ramsey's second step is to pay off all debt (except your mortgage) using the debt snowball method. Baby Step 3: Ramsey's third step is to save three to six months of expenses in an emergency fund.

Dave Ramsey’s 7 Baby Steps Explained GirlTalkwithFo

Microsoft PowerPoint - GACTE Presentation.07.12.11.FINAL.ppt [Compatibility Mode] spending 7 years as a teacher and corporate trainer for various organizations. Christy graduated magna cum laude from Duke University with a B.A. in English. [email protected] 800.781.8914 ext. 5259.

Quick Start Guide to the Dave Ramsey Baby Steps (w/ Printable PDF)

BABY STEP 1 Save $1,000 for Your Starter Emergency Fund BABY STEP 2 Pay Off All Debt (Except the House) Using the Debt Snowball BABY STEP 3 Save 3-6 Months of Expenses in a Fully Funded Emergency Fund BABY STEP 4 Invest 15% of Your Household Income in Retirement BABY STEP 5 Save for Your Children's College Fund BABY STEP 6 Pay Off Your Home Early

The Dave Ramsey Baby Steps

Ramsey's 7 Baby Steps Ramsey Newsletter Real Estate. Mortgage Calculator. This form outlines Dave's recommended percentages for each category, making it easier to set up your budget. Download Major Components of a Healthy Financial Plan